4 steps to maximize your Debt Collection

It can be difficult to manage the large amount of data you receive from debt collection in an effective and accurate way. It costs time, effort and money, and you might miss out on important insights when dealing with several reports at once. But with the right system in place, the process of debt collection will be much easier and create better results.

During our years in the credit industry, we’ve noticed that the most successful credit professionals do things a bit different from the rest. Not only do they collect the right data from the debt collection agencies, they also have a structured process on how to extract the most valuable insights from the data. This enables them to make impactful decisions going forward.

We’ve compiled the success formula on how to deal with data from debt collection agencies into 4 steps.

1. Use several DCA:s and benchmark

How do you know you’re using the best debt collection agencies? One way to find out is to use several agencies at the same time and benchmark their results to see who has performed the best. Our experience is that debt collection agencies are good at different things. Choose your DCA's depending on the market and your different sizes, and types of claims, then benchmark 2-3 agencies against each other.

You can benchmark the results in different areas. For example; how fast they’re collecting debts, and how they’re doing it. But the most important metric to look at is, of course, the cashflow. Which agency is generating the most cashflow, and how active are they? When the results for a given time period is in, you work actively by changing the share for the next period; the winner receives more cases and the one that performed the worst receives less.

Another great thing about benchmarking, is that the agencies will know what’s at stake, and they will work harder to maximize your portfolio potential. Everyone wants a carrot to chase.

2. Standardize your data

When evaluating data from different debt collection agencies, chances are high that they have different ways of reporting their results. This makes it harder and more time consuming for you to compile the incoming data. To be able to compare the results in a fair and effective way, the data needs to be standardized.

This means you need to “translate” all the data into one language. Make sure that the same words are used everywhere to describe the same thing. This may seem time consuming, and it is, but it’s necessary for you to start visualising and benchmark the results from the DCA:s. It’s not until then you can extract insights to improve your work process and increase your profits. Once you have standardized your data, you can begin the process of visualizing the data, uncover patterns and draw insights.

3. Start using the data

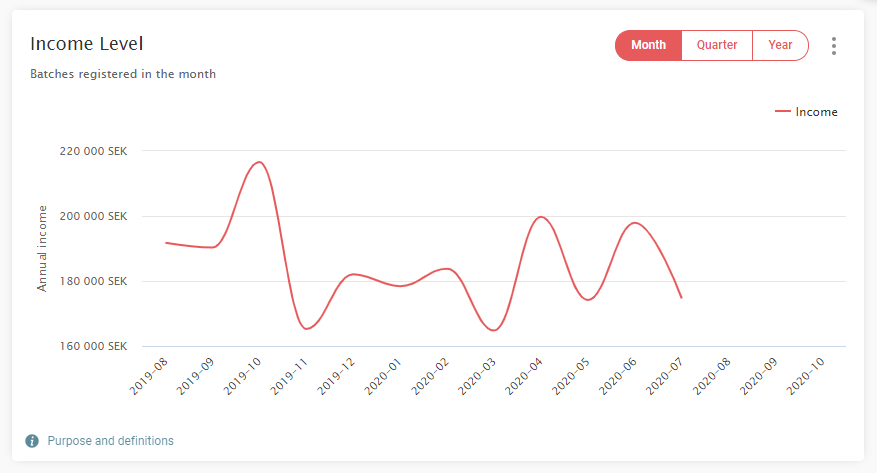

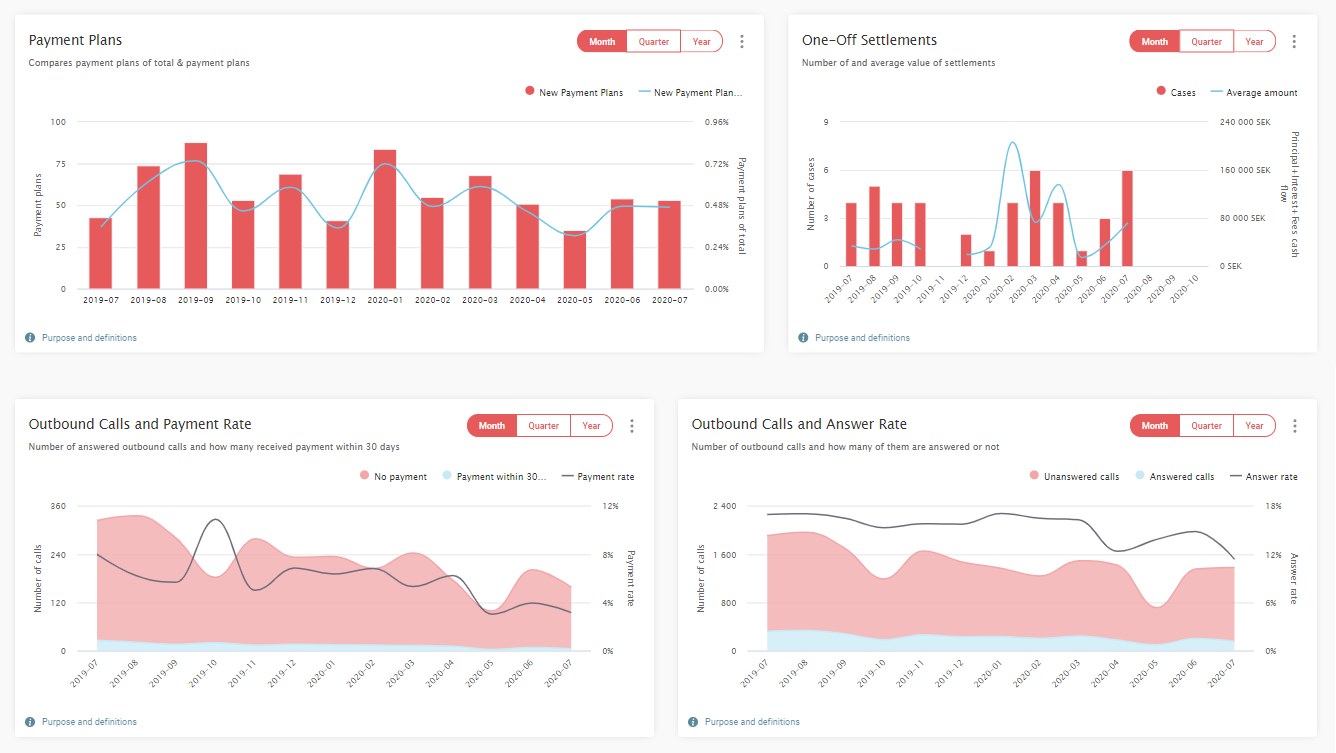

Now you're faced with a great amount of data, standardized into the same language, but you still might struggle to get a quick and easy overview. Without a clear overview it’s difficult to pull the right insights. This means you need to make the data more accessible before you can move forward with the evaluation and start taking action.

Dashboards are the perfect tool to take compiled data and turn it into digestible trends and insights. Here, you might notice that perhaps one agency is using certain actions to collect debt, and these actions result in 20% higher profit. Or you might uncover other tactics that one of the agencies use to get a higher rate of response from a certain target audience,

These trends and insights will help you in several ways;

- You can base your important decisions on correct data moving forward.

- You can surpass your competition, who doesn’t have the same, accurate insights as you do.

- You’ll improve your co-operation with the DCA:s, since you can share your new knowledge and help the agencies in collecting debts, and increase your profit.

- You can challenge your way of operating, and make sure that you and the DCA:s are using the best methods for maximizing cashflow.

This 3-step process is time consuming and takes some administration to nail down. But luckily, there are tools that can help you.

4. Use the right tools

We know that credit professionals in large corporations are working to digitalize and invest in data management within these areas, but we also know the challenge that comes with that kind of investment. We are also well aware of the time and resources it takes to get it right. That’s why we created a scalable solution to everything we’ve talked about in this article, packaged as a SaaS.

With Dignisia we can help you handle the whole process. Our system benchmarks the results from your debt collection agencies, standardizes the data and visualises it. And it takes only a fraction of the time compared to when doing it all manually. Our system picks out the most important data, so that you can focus on the factors that makes the greatest impact on your profits and move forward with more knowledge.

If you want to know more about Dignisia and how we can help you, book a free demo with us here.